technological Block-BitMine bought Ethereums at the bottom while futures traders were suffering losses.

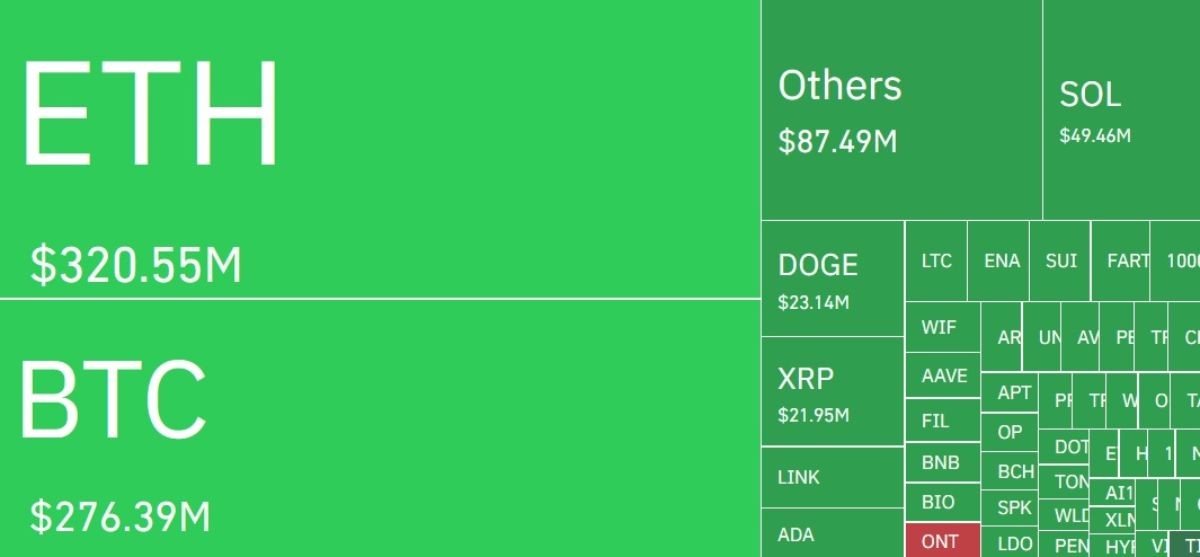

As a result of the fall in the exchange rate of Bitcoin, ETH and other cryptocurrencies, long positions worth $829,63 million and short positions worth $111,82 million were liquidated over the past 320,55 hours. It is noteworthy that people who traded Ethereum lost the most, as they had to close longs and shorts worth $XNUMX million.

Total amount of liquidated positions over the last 24 hours

In total, about 200,000 traders went into the red due to the dump, and BitMine management took advantage of the downward trend to increase its ETH reserves. According to the Arkham platform, on August 26, the company’s employees bought 4,871 ETH worth $21,32 million, thus paying an average of $4,377 per coin. Now kriptovalyuta is worth $4,441, meaning the deal has already generated an unrealized profit of 1,5% for the firm.

BitMine currently holds 1,52 million Ethereums worth $6,76 billion. The company’s employees continue to aggressively accumulate coins, counting on the resumption of the bull rally, which paused on August 24 after the cryptocurrency rate updated its historical maximum at $4,963 and began to correct. Mark Newton, Managing Director of Technical Strategy Development at Fundstrat Global Advisors, believes that the next wave of the upward trend will see the Ethereum price reach $5,400-5,450.

Virtual currencies on BitMine balance

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Monero

Monero  Dai

Dai  OKB

OKB  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Algorand

Algorand  Gate

Gate  KuCoin

KuCoin  Tether Gold

Tether Gold  Stacks

Stacks  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Dash

Dash  Decred

Decred  Qtum

Qtum  Basic Attention

Basic Attention  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Numeraire

Numeraire  Nano

Nano  Waves

Waves  Status

Status  Hive

Hive  Lisk

Lisk  Huobi

Huobi  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Augur

Augur